In a commercial real estate transaction, a seller can leave a lot of money on the table if the buyer is well represented and they are not. Worse still, the seller may look to the buyer’s broker for advice and mistakenly believe that they are being represented and receiving advice that is in their best interest. How do you know if you need independent representation? Every seller can benefit from having their own representation, and I will lay out a few reasons why below, as well as a few case studies.

“Plans fail for lack of counsel, but with many advisers they succeed”

A few years ago, an owner who we will name “Steve” owned an automotive shop on a busy downtown corner. He was approached by his neighbor, who wanted to buy his building for what Steve believed to be a fair price. Steve accepted the offer and closed on the property. A few months later, he realized that due to the capital gain on the fully depreciated building, his taxes were nearly a quarter of the sales price! Not only had he underpriced the building, but after paying off his mortgage, the burden from tax bill started a process which ultimately led to his bankruptcy. If a good agent had advised him, they would have advised him of his tax implications, as well as making sure that the sale price was in line with the market.

About two years ago, a woman we will name “Sherry” owned a home in a downtown neighborhood. Her family was growing, and she wanted to purchase a larger home. She put an offer on a nearby home which was for sale by owner. Neither buyer or seller had any real estate experience, and they used a form they found online. Once the property was under contract, she put her home up for sale by owner. Within days, a buyer’s agent brought her an offer on her home. Sherry wanted to make sure that the contract was contingent upon her closing on the other property, which the buyer’s agent assured her it was. There were some complications with her loan, and the seller of the property she was buying refused to give her an extension—and she was forced to terminate. When she asked the buyer’s agent about terminating the contract on her home, she refused, and said that they would sue for specific performance if she did not sell. Ultimately, she was forced to sell her home under market value, and rented an apartment across the street. If a good agent had been involved, Sherry would not have been forced to sell her home for below market value, and likely would be living right now in what she considered her “dream home”.

4 Reasons to have independent representation

- Representation

- The buyer’s agent has a duty of loyalty to protect their client’s best interest. Some brokers may attempt to practice what is called Dual Agency. Dual agency is a slippery slope and frowned upon by most brokers. Often what happens is that one party is treated as a “client”, and the other as a “customer”—meaning that client receives the duty of loyalty while the customer does not. All these details should be clearly disclosed to both parties, and failure to do is an egregious license law violation.

- Better Leverage

- Another reason to have separate representation is for negotiating leverage. Commercial Real Estate agents, especially CCIMs, are trained to help negotiate the best possible price and terms. If you are communicating any personal details to the buyer’s broker, then they have a duty to tell the seller—which may completely remove any negotiating leverage you may have had. Think about it—any personal details which may make the Buyer think you need the money more than they need the property WILL be used against you. Your exclusive agent’s duty is to protect those details, while working to tip the scales in your favor.

- Pricing

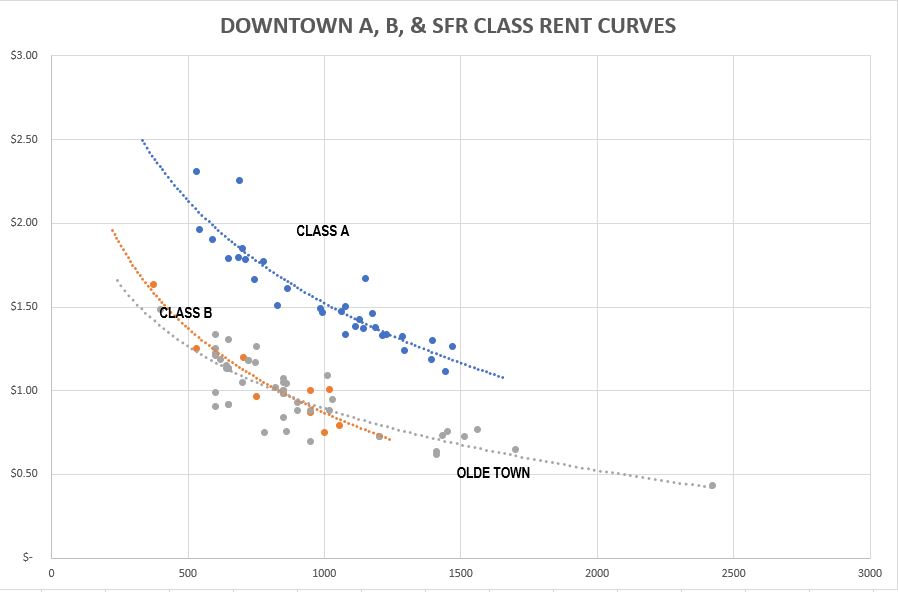

- If a buyer’s agent brings you an off-market offer on a property, how will you know if that price represents a fair market offer? Think about it—if someone is willing to go to the trouble to contact you, to do the due diligence and make an offer, could there be someone out there who would pay a little more? In my experience, off-market properties seem to sell for about 20% less than they might if they were properly marketed. Your agent’s role is to make sure that you are priced in accordance with the market, and not leaving any money on the table.

- Contracts & Due Diligence

- Your agent should be familiar with the documents and amendments you are reviewing and will be able to advise you about their implications. They will be able to suggest language that would better protect you, or additional clauses to add. They should also remind you to talk with your CPA to determine what your tax consequences will look like. You agent will also be able to help with due diligence items required by the Buyer—documents such as leases, tax returns, plats–as well as interfacing with government agencies for things such as permits, zoning details and environmental concerns. They will also be able to connect with the appraiser, and hopefully give them what they need to appraise your property for the highest appropriate amount—something that a Buyer’s agent could not do.

We would love to hear from you! Please comment below. Have you ever been in a situation with an unrepresented party? Or have you ever been in transaction where you lacked appropriate counsel? Do you have any horror stories from real estate deals where good advice could have made a difference?

Additional Resources:

SIOR – How to select a commercial real estate broker

Founders Guide – How to choose the right commercial real estate broker

Commercial Property Advisors – Choosing the right commercial real estate broker

Leave A Comment